PayPal is an American online money transfer website-based system that operates on a worldwide model. PayPal in South Africa is beneficial for both business and personal use. It supports online payment for personal or corporate use.

Can PayPal Be Used In South Africa?

People keep asking the question: Can PayPal be used for transactions in South Africa? My humble answer is YES!

It is true that PayPal has been blacklisted in many African countries.

That notwithstanding, residents of South Africa and many other African countries can still safely create and use a PayPal account.

Data shows that PayPal has opened more than 1 million accounts in South Africa since PayPal was first launched with First National Bank (FNB) in 2010.

It is established that PayPal’s active accounts throughout the whole World now stand at 254 million as of the 3rd Quarter of 2018. This represents a 15% year-on-year growth.

Sources in South Africa have found that there has been a rise of PayPal users because of its quick and cheap methods of money transfers.

Some of them are auction sites, online vendors, and other commercial sites which deals with regular transaction processes.

Sending money in and out of South Africa is now very easy with PayPal.

This is because most eCommerce websites now accept payments through services such as PayPal, Xoom, Venmo, etc in addition to Debit cards and Credit cards.

After reading this guide, you will no longer worry about how and where to get your PayPal account in South Africa.

Note: If you don’t want to read all the posts, you can use the table of contents below to get the information you want:

[lwptoc wrapNoindex=”1″]

Recommended Reading: Why is WhatsApp for Business App so Popular?

Why Is PayPal In South Africa A Must?

PayPal is leading most digital payment platforms such as Apple Pay, Google Pay, Android Pay, and many others.

With PayPal increasing its reach to over 202 countries worldwide, allowing its customers to withdraw money in 56 currencies, and receiving money in over 100 currencies, it becomes imperative that every business-minded entity would wish to tap into this great opportunity.

And I know you are ready too.

Advantages Of Using PayPal In 2021

Here are some of the few advantages you can enjoy when you use PayPal to send and receive money:

- Is smart

- Allows you to accept online credit card payments

- Allows you to sell internationally

- Is more secure and can reduce the cost of fraud and charge-backs

- Offers comprehensive online reports

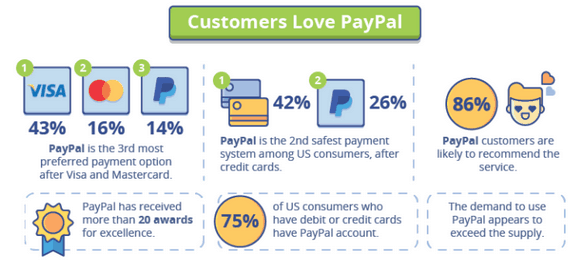

A study confirms that PayPal is the third most preferred mode of payment after Visa and MasterCard. In addition to that, PayPal is the 2nd safest payment system after the Credit card.

PayPal ensures a secure means to make transactions on millions of websites around the world.

Through the partnership with First National Bank (FNB), PayPal users in South Africa can withdraw money from their accounts to any eligible bank account across the country.

Customers can also top up their PayPal account from any FNB bank account anywhere in and outside South Africa.

Recommended reading: Super Easy Business Ideas in Africa

What Is The Difference Between Personal And Business PayPal Accounts?

Just as banks have a different account policy for individuals and corporations, in the same way, PayPal has a personal and business account.

In other words, an individual can use PayPal for their personal use, which is commonly called the Personal PayPal account.

Business management can also make their account under the Business PayPal account.

There are a lot of unique features and differences in these accounts, and one among them is the limitations of holding or maintaining a balance.

For instance, a personal PayPal account can be used to buy products, make payments on online sites or send money to family or friends.

On the other hand, a business account is used to sell products, accept donations, and utilize services that might be needed by an organization.

What Is The Difference Between Billing And Shipping Address?

Imagine you bought a product for your loved one from an online site and wanted to send it directly to them.

Being a gift sent online, you might not want them to know about its price. So what do you do?

You would send the gift to them but might make a special request of not mentioning the price to the delivered person.

This question usually turns up when one is accessing an online site to buy a product.

When a person buys something, then the simple and usual section is the Shipping Address, which means the address where the product is supposed to be delivered.

Now comes the question of the billing address. A billing address is where the bill of the product will be delivered.

This section is useful for Personal, but mostly for Business PayPal accounts.

While buying or selling a product, the user will have the option to send the bill to the exact person who would be filing all the records.

Learn how to set up and use WhatsApp voice and video calls on Android, iPhone, and Windows phones.

What Are The Requirements to Create a PayPal Account In South Africa?

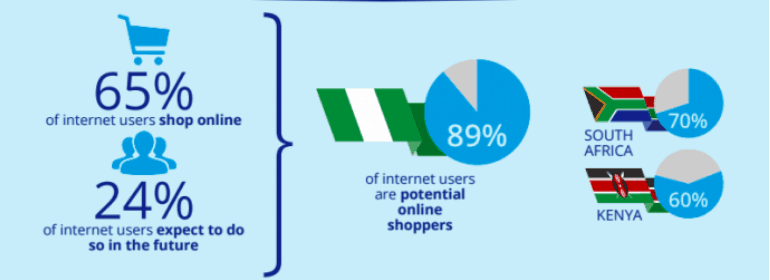

With over 70% of South African internet users shopping online, and most of them using PayPal as their primary mode of transaction, it makes creating a PayPal account not even an option but a necessity.

There are no particular requirements to create a PayPal account, but for South African users, there are specific rules that one needs to follow.

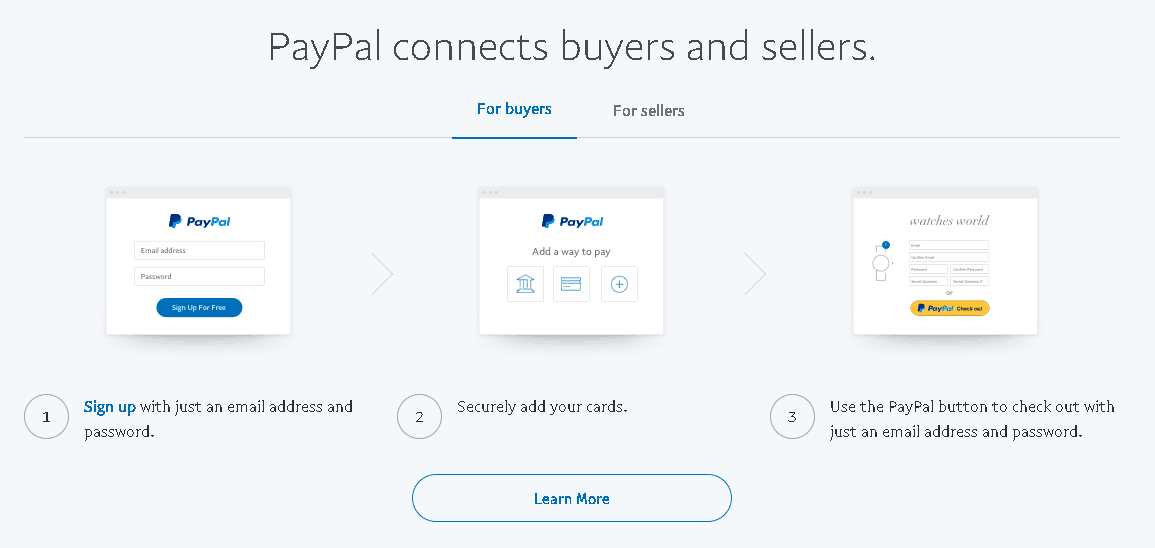

To create a PayPal account in South Africa, here is what you need to do:

- Go to the main website www.paypal.com.

- Then click on the Sign-Up button on the top of the screen.

- Now select what kind of account you want to create – Personal or Business.

- Enter your details and credentials.

- At last, accept the terms and agreements.

- You have now successfully created a PayPal account.

One must remember that PayPal accounts need verification.

So you must have all the FICA documents ready like proof of identity, residence address and proof, and a recent bank account statement.

Recommended reading: Zip codes and Postal codes, What do you need to know?

What Are The Requirements For Financial Intelligence Center Act (FICA) When Using PayPal?

The FICA was introduced on 1st July 2003 to fight financial crime. It helps prevent money laundering, tax evasion among others.

There are about ten (10) categories of people that the FICA identifies and whose information is needed in any financial circle.

The list below outlines the various groups:

- Individual

- Minor

- Non-Residential individual

- Estate Late

- Trust

- Company

- Non-Resident Company

- Close Corporation

- Partnership Account

- Unincorporated entities

Below are the FICA documents required for individuals:

- Copy of National Identity document for South African citizens and Passport for foreigners.

- Proof of address: These documents should be less than 3 months old. It may include a utility bill, shop account statement, Municipal letter, bank statement with an address.

- NB: Some people may not have proof of address in their names and in that case they can provide a declaration by a third confirming that you stay in the same house and hence share the same address.

- You will need a copy of the South African Revenue Service (SARS) document which confirms your income tax number.

- A copy of your bank statement confirming your personal banking details. This should be less than three months old.

For the requirements for the rest of the categories in individuals, see the guide by PSG.

Steps To Successfully Verify Your PayPal Account In 2021

Once an individual has created a PayPal account, it needs to be verified and then registered to a bank account.

Getting verified and registered can give a number of benefits to the user.

Here are the steps to successfully verify your PayPal account in South Africa:

- Go to your PayPal account and select “Add/Edit Credit Card“.

- Fill in all the required fields like name, card details, and billing address.

- Once the details have been filled, PayPal will charge a minimum amount for the verification process, which will later be reimbursed.

- After the card has been added, go to “Add/Edit Credit Card” and click on ‘Confirm my card’.

- To proceed with the process request for your 4 Digit Code.

- For this step, PayPal will again charge a small amount, which will be reimbursed within 4-5 working days.

- After you have received the code, add it using the same process mentioned above and follow the instructions.

- This whole process makes your PayPal account verified.

What Are The Steps For Linking PayPal Account To Your South African Bank?

After the verification process has been done, below are some steps to connect your PayPal account with any South African bank:

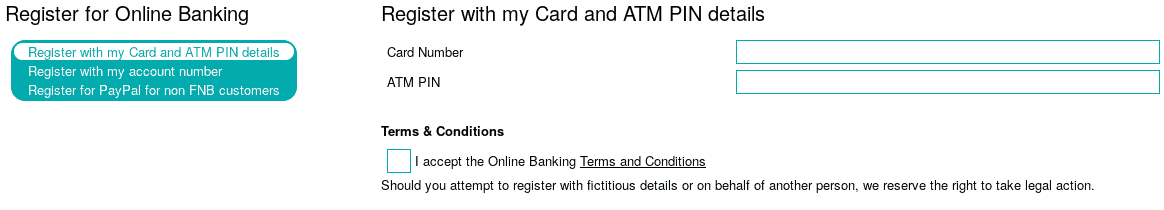

1. Go to First National Bank’s website and click on Register for FNB PayPal Service.

2. Select the type of PayPal account you are registering with.

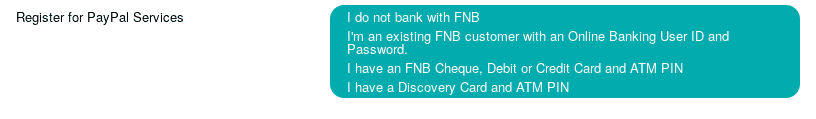

3. Then confirm if you are a user or bank with FNB or not.

4. Click on I Do Not Bank With FNB

Note that this process is done to link PayPal with any South African Banks.

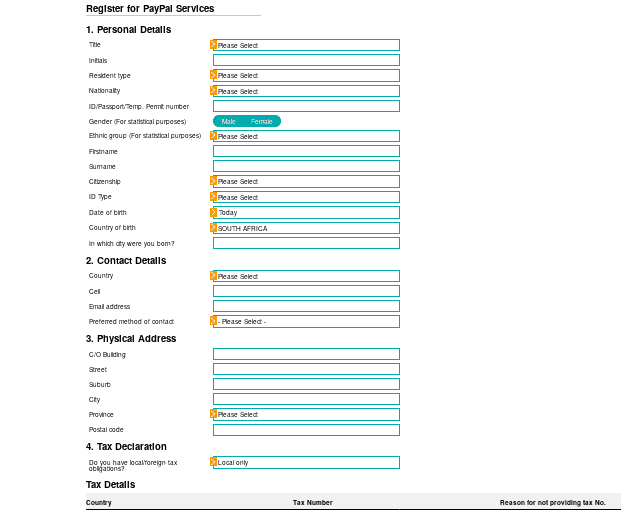

5. After that, you will have to fill up the registration form with your details.

Then, create your user ID and password with FNB bank.

Confirm the page and details that you have given, and then download the PDF.

6. Click on Submit

This PDF document will also mention where one has to submit their FICA documents.

After the whole process is done, you can verify with PayPal with your particular bank account.

Recommended reading: List of the Best Insurance Companies, and which one is good for you?

Which Banks Support PayPal in South Africa?

The official bank in South Africa to transact with PayPal is the First National Bank (FNB).

The FNB has however opened up access to the PayPal service so that people with accounts at any of the South African banks can link their bank accounts to their PayPal account and send or receive money.

Anyone who has registered with FNB PayPal banking services can access and link PayPal with any South African bank account.

Major banks like ABSA, Nedbank, as well as Standard bank all can be linked to PayPal in South Africa.

How To Link Your Credit Card With PayPal Account In South Africa?

To add a Credit Card to your PayPal account, follow these steps:

- Open your PayPal account home page.

- Click on “Wallet” at the top of your page.

- Then, click on “Link a payment method” and select “Credit Card”.

- Now fill in the details and follow the instructions to confirm and verify the card.

READ ALSO: Top 5-Star Hotels In Kenya To Book Now.

What Can You Do With PayPal In South Africa?

For those South Africans and even anyone who owns a PayPal account, these are some of the things you can use your PayPal account for:

- Sellers can receive payments from customers in over 190 countries and regions around the globe.

- Use your PayPal account to make or receive international payments for goods and services online.

- Securely pay for items and send money without sharing your credit card details.

- You need to check out quickly and safely at your favorite online stores.

- Shop online: PayPal is supported by merchants in over 67 countries and regions all over the world.

Like I said earlier sending money or making payments online can be done in several ways in South Africa and not only through PayPal.

Most eCommerce shops accept payments through Xoom, Venmo, and other means of money transfers.

How To Withdraw Money From PayPal Account?

To withdraw money from your PayPal account, follow these steps:

- Open your PayPal account main page.

- On the left side of the screen, click on PayPal Balance, and then select Withdraw Money.

- Enter the amount you want to withdraw and also select the withdrawal method.

- Review the details and then click on Withdraw.

After following the steps above, you will be able to easily withdraw money from your PayPal account in South Africa.

You can use the method described above to withdraw money from both your personal PayPal and business PayPal accounts.

Recommended reading: Personal training Business Ideas.

How To Find PayPal Routing Number Or Account Number For Direct Deposit?

To find your routing number for PayPal, follow the steps below:

- Go to your profile

- Click set-up or view direct deposit

- You will see the routing number and account number displayed if you have direct deposit enabled on your account.

Conclusion

PayPal is a user-friendly online money transfer system that can be linked with any bank in South Africa.

It gives users the option to extend their business and use this fast transfer process and also helps individuals with easy banking and shopping experience.

PayPal in South Africa is obviously one of the safest and most convenient means of transaction for those who want to enjoy the benefits of digital banking.

One must be careful to verify and register their accounts to enjoy the full benefits of PayPal.

If you have found this guide helpful, share it with others.

If you also have any issues or any suggestions to make feel free to share your opinion in the comment section below.

Is PayPal Available In South Africa?

Yes. PayPal is available in South Africa. You can register for an account using the information provided above.

Please you need to take note of the PayPal South Africa terms and conditions.

How Does PayPal Work In South Africa

Here is how PayPal work in South Africa:

- Visit the PayPal South Africa main website.

- Create an account.

- Verify your details.

- Connect your PayPal account to your South African bank.

- Finally, use your account to send or receive money in and outside South Africa.

That is how PayPal works in South Africa.

This simple and easy article Was Last Updated on by Nana Abrokwa

Please you wish to visit this post “https://thebusinessalert.com/paypal-south-africa/” ocassionally for changes and updates that we will make to this article.

Check this ultimate guide: https://thebusinessalert.com/sunlearn-student-portal-login/

In the year 2022, we bring you the best of banking and money transfer experience. Just stay tuned for more articles.

Check this ultimate guide: https://thebusinessalert.com/irs-code-290/

Here is the main list of our latest guides for May 2022, check them:

- Honeywell Home RTH6580WF Wi-Fi 7-Day Programmable Thermostat

- Bereal App Download, Install Bereal App On Your Phone

- How To Unfriend Someone On Bereal, Unfollow On Bereal

- Is Bereal Down, No, But, Here Is A Fix

- How To Post on Bereal Late, Post Later On Bereal

- Bereal Screenshot, Take A Screenshot On Bereal

- How To Take A Bereal, Follow These Steps

- What Is A Bereal App, Find Out How It Works

- How Does Bereal Work, Get Full Details Below

- How To Post A Bereal, Step-By-Step Guide

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours.

The PayPal system in South Africa is not as straightforward as it is in other countries. You have made it clear for me.

It’s pretty worth enough for me. Personally, if all website owners and bloggers made good content as you did, the net will be a lot more useful than ever before. Thanks for the good and informative post.

Hi Callis,

Thanks for the words of encouragement.

Am Anthony from South Africa. I like the layout of your website. It is very simple to use. I want to know if I can get money transferred to my capitec account?

Sending and receiving money through PayPal using Capitec account is a daunting task. I recommend you use FBN.

Is it POSSIBLE to use a Capitec Account if you don’t have an FNB account? You said it is a daunting task.

Thanks for this guide. We the South Africans have been left behind for too long. Common paypal and FBN has taken monopoly over it.

Hi Wayne,

Thanks for passing by and leaving a comment. That is how the PayPal system has been made to be in SA. Lets hope for the best in the near future.

Kindly send me the details on how to create paypal account and entrepreneurship or opportunities available.

Hi abbrokwa,

i have followed your guide step by step and i have successfully registered for my paypal account.

thank you.

Please i am fro Nigeria but registered my Paypal account in SA. My question is how do I withdraw money from PayPal in South Africa?

hi there i tried to open a paypal account ,now but there is no south africa to click on ,what do i do

Hi Marlon,

If you want to create a PayPal account in South Africa, use this link https://www.paypal.com/za and start the process of registration. Let me know if you still have any challenges.

How do I withdraw money from paypal account to Nedbank account

Thank you so much for this. I am just really struggeling to get in touch with Paypal. I opened an account some years ago but cannot get verification on my password to login and when I do I cant answer the security questions. there is no option to email them unles you are logged in. Ive messaged them via FB where they requested I use a number in the States to get this info but the nuber (14025174519) does not work from South Africa. I tried placing a Zero infront of it from both landline and mobile. I tried their UK portal and numbers also without success. This is just becoming really frustrating I was wondering if you had any advice.

Hi Steve,

Here is a comprehensive guide on how to contact PayPal: https://thebusinessalert.com/contact-paypal-customer-service/

Hi Steve, don’t know if you ever figured this out, but for anyone who has this problem – you have to add 2 zeros in front of the number. This is a Nebraska number and from South Africa, you will dial it as 001 402 517 4519. Hope this helps someone.

Hi, I have a query regarding this service. I have a Standard Bank Cheque Account (which is not a Credit Card). Can I possibly link my Standard Bank Cheque Account to PayPal and withdraw funds successfully without actually having an FNB account? If so, could you please help me out and explain to me step by step how to go about doing this correctly as I am not tech savvy. Thank you.

Hello Krish,

It is advisable to contact PayPal to get your Standard Bank account linked to your PayPal account.

To withdraw from paypal I used etopayzar.blogspot.com although they charged about 20% transaction fee but i was glad i got my money, they have a withdrawal option of Bank account, E-wallet and cashsend I got the money in 5 days through Email.

Good to hear that.

I have Fnb bank cheque card not credit card is possible that I can buy online in uk? Let me know please…

Thank you

Mpho

Hi Mpho,

Kindly contact FNB bank in that regard.

Please can someone send money from S. A to Nigeria using paypal.

For PayPal Nigeria, you can ONLY send money outside Nigeria but not receiving. This means you can not under normal circumstance send money from South Africa to Nigeria through PayPal.

Hi! I have a question

Is it possible for someone (foreigner) in South Africa to open a PayPal account for someone who is outside South Africa?

Yes, as far as PayPal works in that country “outside South Africa.”

HI, IM IN SOUTH AFRICA AND ILL LIKE TO OPEN A PAYPAL ACCOUNT.

Hello Nthabiseng,

Please take your time and go through the guide for creating a PayPal account in South Africa.

How much are paypal account verification costs, currently?

Hi Pat,

PayPal account verification does not cost much and whatever amount deducted during the verification process is refundable afterward. So feel free to verify your account. You have nothing to lose.

Can l open a Paypal account without a credit/debit card?

The PayPal dashboard varies slightly from country to country. Moreover, the Business Account is more flexible than the Personal Account. Hence it depends on several factors.

I want to open pay pal accounts, i don’t even know were to start. Im in SA i want to parchase things in China.

South Africa makes everything so complex. Common paypal registration too you have to face so many difficulties. Thank you for this guide!

Keep this going please, great job!

Hi, l opened PayPal l use bidvest bank but am trying to put my bank account don’t want to go through.

I had an FNB account 25 years ago, and my details have changed since then. Every other bank’s HAFIS system has updated, except FNB. Since I don’t have the ID document from then anymore, my profile can’t be activated/fixed/used ever again. They refuse to accept my newest ID document even though it’s more than 10 years old.

Is there any way to cash Paypal funds out directly to a Capitec, Standard Bank or ABSA account?

Many thanks

Camilah

I have also struggled but there is a website that charges way too much yet it is worth it if you want your money out of the paypal account, they have quite several options available to withdraw from paypal as long as you are in South Africa.

It is called etopayzar, their website is etopayzar.blogspot.com

NB: Only available for South Africans

Good Day

I have incorrectly made a payment online to us embassy on Monday last week online via PayPal. The payment of R2403. I wish to be refunded the money paid as it was incorrectly paid through my FNB account.

Please help I tried many time to register PayPal account but I can’t always password not match I don’t know how because it’s my first time to register PayPal accont

Please reply I need help why password not match when I’m trying to register PayPal account

Hi Mahai,

Sorry for the frustrations you might be going through. The error message you are getting is an indication of password mismatch. You can simply solve that by heading to the PayPal login page.

Click on “Having trouble logging in”.

Enter the email you used for PayPal account registration.

Click Next and follow the instructions.

PayPal will assist you to create a new password.

Hope that works for you.

I never register PayPal since I was trying to register and I tried trouble shooting I got the same problem

Thank you for an informative page!

Just fyi, there are two phone numbers for PayPal customer services on the same FNB page!

0861 729 725 does not work!

0875 729 725 works perfectly! And I even got to speak to a human! And he was able to answer my question! A trifecta of success!

Can I apply for a PayPal account in the FNB branch

Hi Malibongwe,

Glad to see you here.

The best way to apply for a PayPal account in South Africa is through their website.

Thank you for detailed information, this is very helpful. Do you know how to get a SAR number for a foreigner (Diplomat) living in South Africa for creating Paypal account.

Hi. Thank you for trying to help so many of us. I’m with ABSA. I have done all the necessary registrations. All was initially well when my current cheque account card expired. I now can’t link a new card as paypal wants a routing number. I registered with FNB online banking enterprise a few years back. I’m not able to access my FNB profile as it says that my username is incorrect but when I check, my records are correct. I really don’t have a clue what to do. I’m out of the country at the moment. Please, please can you help me.

I am trying to update my contact number to log into my PayPal account, send numerous emails, but to no success. It’s so frustrating!

Hi. Thank you for an informative article. Is there any requirement on how often one needs to withdraw money from Paypal account?

Good day l want to ask l have my PayPal account loaded with my absa credit card it keeps returning me to the merchant so how can l use it

Please how do I change my password with epayslip

Hi, Thank you for the information. I have a Paypal account (verified) and opened an FNB profile so I could receive funds from USA. I bank with Standard Bank. My question is how do I link my FNB profile/Paypal account to my Standard Bank account

I went into Standard Bank today and they say that FNB needs to link to Standard Bank. Is that correct?

I appreciate any help you can give me, please.

Great guide on how to use PayPal in South Africa. You have made this so simple and easy for me. You saved a brother today. I can’t thank you enough. Keep up the good work.

It must be noted, as a business you can see some hectic fees incurred for accepting a variety currencies. Ie. If your account is in USD and you get paid in GBR.

About a 4.5% fee for accepting/billing a client.

Then a exchange rate to turn the GBR to USD, just as you cash out to FNB. That’s 2.5%+. I got 4.4% they are crooks with this.

Then FNB exchange at 1.5% , not so bad, plus a service fee.

So about 10% of your bill is gone. Not great for receiving large payment for products and services…

Do be careful

On number 7. Access details, do you put the FNB User ID and password or PayPal User ID and password. Can i please get an example of User ID .

Good day

I’m from South Africa, and had my PayPal account for over 2 years now.

What a nightmare to link a bank account, I went to the FNB site and everyone when I fill my details it gives me an error code, is there any other way I can use my PayPal funds, none of the grocery stores in South A frica accepts PayPal.

I have funds but I can’t use it, it is really frustrating.

Please help

Regards

Lenette