Most farmers do not realize the importance of agricultural insurance until the later days when they are struck by that unforeseen calamity which significantly affects yield as well as income.

Admittedly, farmers form a significant chunk of the world’s poor. Some farmers keep asking me what agriculture insurance is.

Not because they need one but because they are only asking.

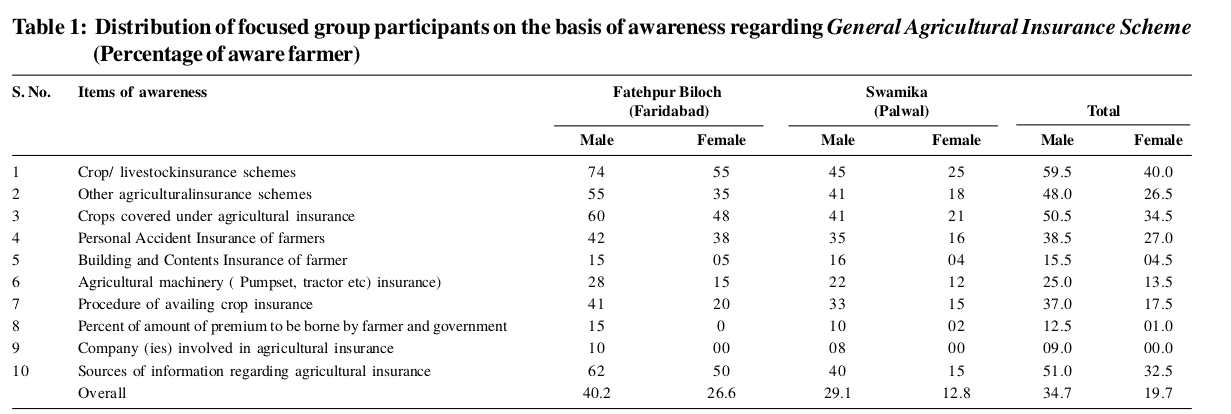

Extensive research done by three(3) India Scholars shows that 34.7 percent of male farmers and only 19.7 percent of female farm women were aware of the agricultural insurance schemes in general.

Most farmers don’t see the reason why they should invest in insuring their farm produce be it crop or livestock.

Not only that but also farm insurance is ignored in discussions on financial inclusion. This makes the subject unattractive for the main stakeholders in farming.

However, it doesn’t take away the relevance of agricultural insurance as it reduces losses farmers suffer due to unforeseen events.

Agricultural insurance is the insurance of crops, animals, as well as farm property and equipment.

It is a policy where the farmer pays an amount of money usually in percentage, to an insurance company to guarantee against losses.

These may be due to an unfortunate event (death, flood, drought, etc.) covered for a particular period with a promise to pay back the value of loss should such occur.

Recommended reading: MiLife Insurance Company.

Agricultural insurance and public policies of risk management

As we have explained, nowadays most agricultural insurance contractors are medium and large producers.

Small ones generally prefer to seek government subsidy programs that usually end up covering eventual losses suffered as a result of adverse weather phenomena.

Government programs, however, make many demands for the insurer to apply.

Sometimes the indemnities paid, take into account the difference between the product’s guarantee prices and the market price.

The agricultural insurance is, therefore, used to minimize the risk of changing conditions in the markets, financial risk or price changes.

In this regard, agricultural producers are encouraged to use insurance to reduce the risk of weather and partial or complete destruction of agricultural assets.

Besides, the availability of insurance improves the creditworthiness of farmers.

This is designed to encourage farmers to keep up with the latest scientific advances in technology for growing crops or animals.

It also helps them sleep better at night knowing that should the unexpected happen; they will have financial security.

This will help them stay in business and go on to plant the next season thus guarantee the continuity of their business.

Read Also: Top 20 Super Easy Business Ideas in Africa.

Is there single insurance coverage for Agriculture?

The answer is obviously NO.

Since there is a myriad of farming businesses, there is apparently no single insurance to cover all of such activities.

There are however three main classes of agriculture insurance:

- Crop Insurance

- Livestock insurance

- Farm property and equipment insurance

There may be other forms of insurance for farmers which may not fit squarely in the above mentioned three categories.

Read Also: List of Best Insurance Companies.

Types of agricultural insurance

Agricultural insurance can be of various kinds, including the following:

- Crop Insurance

- Livestock Insurance

- Bloodstock Insurance

- Forestry Insurance

- Greenhouse Insurance

Crop insurance

Crop Insurance can play a significant and supporting role in increasing the flow of institutional credit to the agriculture sector.

Agricultural Insurance will mostly solve the problem of collateral security requirements by banks while extending the loans.

In the case of Crop failure, banks will receive the payment directly from the insurance companies.

Types Of Crop Insurance

- Named Peril Crop Insurance

- Multiple Peril Crop Insurance

- Crop Revenue Insurance

- Area Yield Index Insurance

- Weather Index Insurance

Yield insurance covers the loss of yields that can occur due to non-controllable weather adversities, such as drought and frost, among others.

Another useful article: How To Buy ECG Prepaid Online.

Comprehensive insurance

Comprehensive insurances cover the loss of production caused by phenomena that can not be controlled. These include such as hail, fire, drought, etc.

According to a study by CropWatch, hail affects many communities and industries annually. It causes yearly economic losses of over $1 billion.

Check out this: List Of Top Insurance Companies In South Africa.

What is Agriculture Insurance under Livestock?

To insure your livestock is called Livestock insurances.

It prevents losses caused by accidents and diseases of animals, expenses incurred by dead animals or damages due to drought in pastures, among others.

Livestock insurance provides insurance products to cover farm animals.

It is a relatively small segment of the market accounting for 4% of the total agricultural insurance premium written worldwide as of 2008.

Read also: Agriculture Business Ideas in Africa.

Aquaculture insurance

Aquaculture insurance provides cover for producers involved in breeding and raising aquatic fauna and growing aquatic flora.

In addition to flatfish, aquaculture encompasses mollusks, crustaceans, and commercial seaweed cultivation.

Although it is a small segment of the market with 1 percent of written premiums for the worldwide agricultural insurance market in 2008, it is expected to develop rapidly as aquaculture becomes more critical in the face of dwindling natural fish supplies.

Check out: How to Contact PayPal Customer Service.

Combined agricultural insurance

The combined agricultural insurance covers the damages caused in the insurable risks according to the location of the farm, the species that are cultivated, etc.

Among others, it offers coverage against fire, frost, rain, snow, hail, and wind, etc.

Agricultural insurance has a long history characterized by the search for balance solutions between the protection of farmers and the insurance technique.

Among all farm insurance, the system of combined agricultural insurance is a balanced and stable solution for farmers.

According to Farm Bureau, farming is a risky business, so farmers utilize a multitude of risk management strategies to manage the enormous hazards they face every year when they plant a crop.

However, crop insurance is the only risk management tool that farmers can take to the bank to prove their ability to pay back annual operating loans required to keep the farm going.

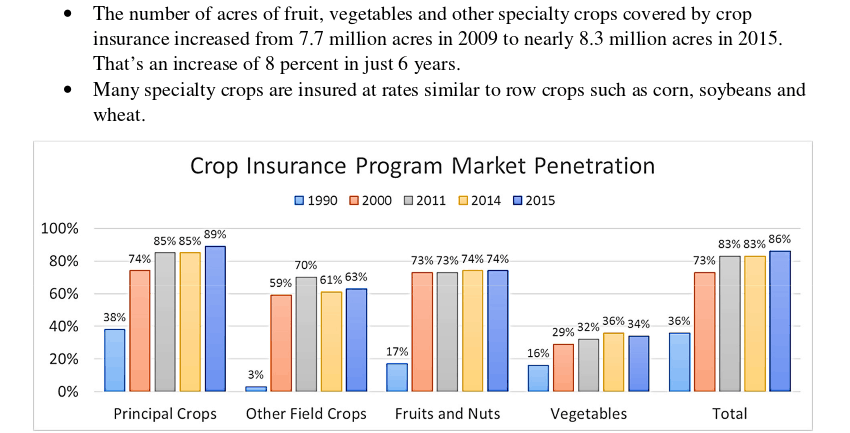

Some people believe that Crop insurance is only for corn, soybean, wheat and cotton farmers.

But studies conducted by Farm Bureau show that Crop insurance is available for more than 120 crops and to farmers of all sizes and in all 50 states.

The 2014 Farm Bill included provisions to make crop insurance an even better risk management tool for beginning farmers and ranchers.

These provisions have only been implemented for one full year, yet have had a meaningful impact.

Recommended reading: How to Start Palm Oil Business in Nigeria.

Why is it essential to take out agricultural insurance?

The agricultural activity is subject to risks related to natural weathering, such as hailstorms, frosts and drought seasons. Having insurance helps in the following:

- Immediate protection of the investment made in the crop

- Comprehensive comprehensive coverage

- Subsidy of 60% of the cost of the premium, if contracted through the MAG

- Helps to fulfill the economic obligations of the farmer

When choosing an insurer, it is worth paying particular attention to reviews on the websites of insurance companies.

They reflect the real state of affairs in agri-insurance and help you better orient yourself in the proposals.

You can also rely on ratings compiled by experts from independent rating agencies.

This simple and easy article Was Last Updated on by Nana Abrokwa

Please you wish to visit this post “https://thebusinessalert.com/what-is-agriculture-insurance/” ocassionally for changes and updates that we will make to this article.

Check this ultimate guide: https://thebusinessalert.com/sunlearn-student-portal-login/

In the year 2022, we bring you the best of banking and money transfer experience. Just stay tuned for more articles.

Check this ultimate guide: https://thebusinessalert.com/irs-code-290/

Here is the main list of our latest guides for May 2022, check them:

- Honeywell Home RTH6580WF Wi-Fi 7-Day Programmable Thermostat

- Bereal App Download, Install Bereal App On Your Phone

- How To Unfriend Someone On Bereal, Unfollow On Bereal

- Is Bereal Down, No, But, Here Is A Fix

- How To Post on Bereal Late, Post Later On Bereal

- Bereal Screenshot, Take A Screenshot On Bereal

- How To Take A Bereal, Follow These Steps

- What Is A Bereal App, Find Out How It Works

- How Does Bereal Work, Get Full Details Below

- How To Post A Bereal, Step-By-Step Guide

Thanks for explaining the different coverage options for farm insurance, such as crop failure or livestock losses from accidents or disease. Knowing the various options would be useful to figure out what coverage you need for your farm. It could then give you the opportunity to research the policies offered by the different companies to determine which one can protect your crops, livestock, or anything else you have so you can get the help you need for any accidents or other problems.

wrg-ins.com

Hi Erika,

Thanks for passing by and leaving this insightful comment. I really appreciate your time.