Life insurance is not expendable and is important even for those who do not have dependents or have a policy offered by the employer. But when is life insurance worth it at all?

Life insurance is not expendable and is important even for those who do not have dependents or have a policy offered by the employer. But when is life insurance worth it at all?

If you are one of those who neglect life insurance because you believe that you will not be the one to benefit from it, or you think that the life insurance offered by your employer is sufficient, know that your ideas can be quite wrong.

Life insurance offers several benefits even for those who do not have dependents, such as the spouse, partner or children.

It is an important patrimonial protection for those who do not want to suffer financial suffocation.

Here are four reasons why you should buy life insurance:

1. Life insurance is not just for death

Life insurance does not only offer coverage for accidental or natural death or events related to the insured’s death, such as funeral care.

It can offer a number of important coverages that the insured person can enjoy in life.

A good example is a coverage for temporary or permanent disability, whether in the event of accidents or illness.

It also covers medical and hospital expenses in certain situations, indemnities in case of serious diseases such as terminal illness and even in times of death.

Recommended reading: Santander Online Banking – The Ultimate Guide To Digital Banking

2. Even those who do not have dependents can have life insurance

Even people who are not financially responsible for anyone may need life insurance.

Death coverage, in these cases, may not be as relevant, but temporary or permanent disability coverage is very important.

After all, these people are dependent on themselves, and may not have anyone else to count on financially.

The financial impact of losing the ability to work and earn income can be devastating, especially in the case of self-employed workers. For these people, even a one-month break is enough to cause a big dent in the budget.

Read also: How to Contact PayPal Customer Service.

As a couple, Is Life insurance worth it?

According to a study done by coverme.com, as a couple, you should consider life insurance as well as health and dental insurance to protect your budget from rising health-care costs that are not covered by your employer. Look at the screenshot below:

3. Your company’s life insurance may not be enough

Many employers offer life insurance as a benefit to their employees. If you are an employee, is a good strategy to accept it, but the coverage is often very low.

It may also not suitable for the financial situation of policyholders.

One has to consider taking a life insurance policy considering the family income and the standard of living.

It is okay to have more than one life insurance, one by the company and that of you the individual. So, consider the real financial needs of your family when thinking about coverages.

Recommended reading: How to Make Money With Palm Oil Business.

4. Life insurance does not go into inventory.

Life insurance does not go into the inventory in the event of the insured’s death.

This avoids a lot of bureaucracy at this difficult time for the family.

Thus, the indemnity amounts go directly to the beneficiaries, immediately guaranteeing their expenses.

In addition, life insurance beneficiaries need not be the insured’s heirs. It is possible to designate persons who will not be entitled to the insured’s inheritance without the existence of a will.

For example, if you have children, they are your required heirs.

But if you want, you can designate a nephew with one of the beneficiaries of the insurance, even if he has no right to inheritance.

With that said and done, there is the need to make this note about the refusal of life insurance claims.

Read also: How to Track Your Package With FedEx.

Reasons Why They Refused Your Life Insurance Claims

There are many instances where your life insurance claims will be turned down and you will be wondering why.

This is what you need to know.

These are the reasons why insurance companies refuse your life insurance claims:

Misrepresentations On Applications

Omitting or lying about information regarding medical history, income or other items on an application is called a material misrepresentation.

This can seriously affect the insurance claim to some reasonable extent.

Check out this: How To Buy ECG Prepaid Online.

Mortgage Payment defaults

This usually happens to people who for one reason or the other choose to pair their life insurance policy to their Bank mortgage.

Banks generally have more reasons to refuse a claim than a personal policy, making it advisable to buy a personal life insurance policy that is separate from your mortgage.

Read also: List of The Best Real Estate Companies in Ghana.

Reasons you were turned down for life insurance

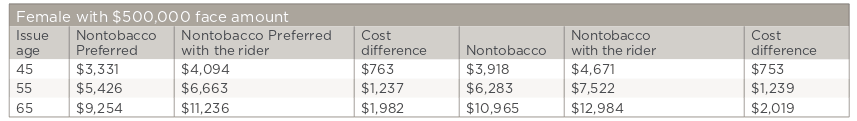

Below is the analysis of the cost of a life insurance policy by men and women of the same age group with the same income levels:

From the table above, you can see that Men between the ages of 45years and 65years pay more for life insurance coverage than their female counterparts.

There are other instances why your application is declined and it includes the following:

- Specific health condition

- Hazardous occupation

- Hazardous extra-curricular activity

- income limitations

This simple and easy article Was Last Updated on by Nana Abrokwa

Please you wish to visit this post “https://thebusinessalert.com/is-life-insurance-worth-it/” ocassionally for changes and updates that we will make to this article.

Check this ultimate guide: https://thebusinessalert.com/sunlearn-student-portal-login/

In the year 2022, we bring you the best of banking and money transfer experience. Just stay tuned for more articles.

Check this ultimate guide: https://thebusinessalert.com/irs-code-290/

Here is the main list of our latest guides for May 2022, check them:

- Honeywell Home RTH6580WF Wi-Fi 7-Day Programmable Thermostat

- Bereal App Download, Install Bereal App On Your Phone

- How To Unfriend Someone On Bereal, Unfollow On Bereal

- Is Bereal Down, No, But, Here Is A Fix

- How To Post on Bereal Late, Post Later On Bereal

- Bereal Screenshot, Take A Screenshot On Bereal

- How To Take A Bereal, Follow These Steps

- What Is A Bereal App, Find Out How It Works

- How Does Bereal Work, Get Full Details Below

- How To Post A Bereal, Step-By-Step Guide