Are you really planning to take a Home Loan, Auto Loan, Student Loan, Personal Loan, or any other mortgage from FNB Bank South Africa? You certainly need to plan well. Use the FNB Bond Calculator as a guide.

The FNB South Africa loan calculator will help you make a determination on the monthly payment schedule and the total amount to be paid at the end of the loan term.

You can use the bond calculator for a mortgage, personal, or auto loan and even other fixed loan types in most cases.

Why Do You Need A Loan

Let’s face it. Without loans, some of us will definitely not be able to buy a car, a home, or even afford higher education. This does not apply to only FNB Bank customers in South Africa but the whole world.

In most cases, people shy away from loans because of the interest and the repayment terms that most people cannot afford.

But the truth is, the actual cost of the FNB loan depends largely on your income, the lender, type of loan, your credit history, and even the market environment.

If you are a borrower with a good credit profile, you stand a chance of getting the best interest rate.

Now you know the importance of taking a loan, it is time to use the FNB bond calculator to know the monthly repayment based on the cost, term, and loan amount.

If you are ready, then continue reading the rest of this guide.

See this too: Current Treasury Bill Rate.

What Is The FNB Home Loan Bond Calculator

This is a simple tool that you can use to calculate your loan repayment.

It gives you the opportunity to know how much you will pay for a given term at the prevailing interest rate.

The calculator has predesigned values, but you can insert your own values to do the calculation.

How To Use The FNB Bond Calculator For Loans In South Africa

Follow these steps below to use the FNB Bank South Africa home loan bond calculator:

- Go to the FNB Bank’s main website here: https://www.fnb.co.za/.

- When you get to the FNB South Africa homepage, click on the “Calculators” tab.

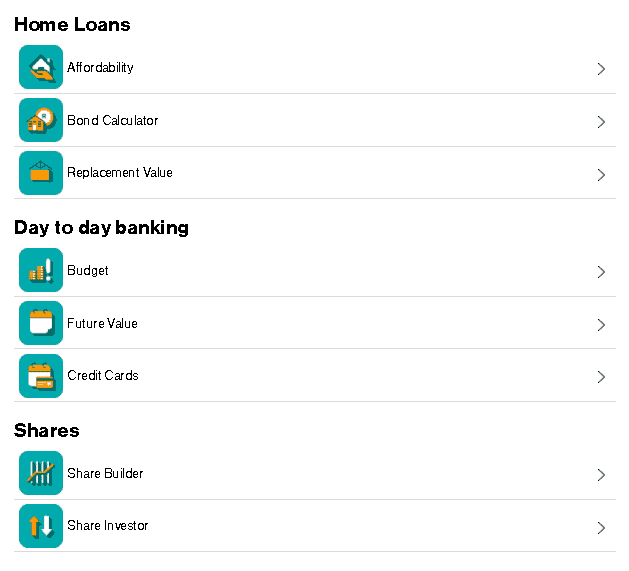

- A pop-up new window will open for you to select one of the options.

- Select “Bond Calculator” and proceed.

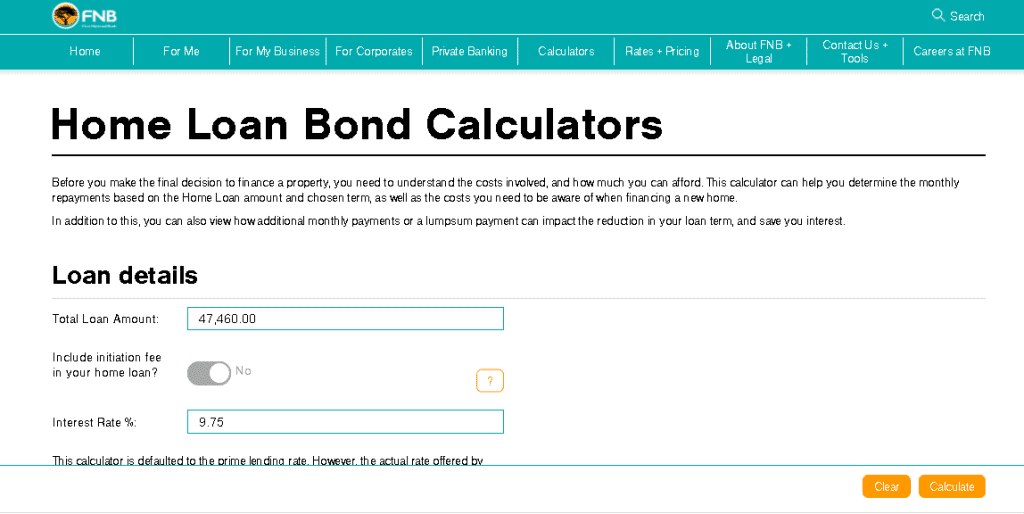

- The FNB Bond Calculator page will open.

- In the “Total Loan Amount,” enter your figure there.

- Make sure the “Interest Rate” appears in the next box.

- After that, enter the “Loan Term” in months, and the FNB Bond Calculator will compute that.

- If you want to check “Additional Monthly Payments,” enter the details in the sections below.

- But note, that is optional.

- To make additional lump sum payments for the loan term, enter “Lump Sum” in the first box.

- After that, select the year and continue with the bond calculation.

- Check if all the information you have entered is accurate.

- Finally, click on the small “Calculate” button at the bottom of the calculator.

That is how to use the FNB South Africa bond calculator.

Check this guide: List Of Top Insurance Companies In South Africa.

How Does The Calculator Display The Results

After you have successfully inputted your information into the calculator and submitted it, you get a result with all the information regarding your initial cost, monthly installment repayment, total repayment, and a graph of the total payment and the corresponding months.

How Do I Qualify For A Home Loan At FNB?

You must meet all the requirements indicated by FNB Bank South Africa to qualify for the home loan.

Here is a comprehensive list of all the documents and other requirements for you to be eligible for the FNB home loan:

- Proof on income.

- Your South African identification document.

- Proof of residence.

- A copy of your marriage certificate (where applicable).

- A copy of the FNB “Debit Order Authorisation Form.”

- Completed “Home Loan” application form.

- Financial statement (If self-employed).

- Access funds for Further Lending application form (where applicable).

- Flexi Option Request application form (where applicable).

That is all you need to know about the FNB Bond Calculator and how to qualify for the FNB home loan.

Recommended reading: List Of Standard Bank Branches In South Africa.

This simple and easy article Was Last Updated on by Nana Abrokwa

Please you wish to visit this post “https://thebusinessalert.com/fnb-bond-calculator-guide/” ocassionally for changes and updates that we will make to this article.

Check this ultimate guide: https://thebusinessalert.com/sunlearn-student-portal-login/

In the year 2022, we bring you the best of banking and money transfer experience. Just stay tuned for more articles.

Check this ultimate guide: https://thebusinessalert.com/irs-code-290/

Here is the main list of our latest guides for May 2022, check them:

- Honeywell Home RTH6580WF Wi-Fi 7-Day Programmable Thermostat

- Bereal App Download, Install Bereal App On Your Phone

- How To Unfriend Someone On Bereal, Unfollow On Bereal

- Is Bereal Down, No, But, Here Is A Fix

- How To Post on Bereal Late, Post Later On Bereal

- Bereal Screenshot, Take A Screenshot On Bereal

- How To Take A Bereal, Follow These Steps

- What Is A Bereal App, Find Out How It Works

- How Does Bereal Work, Get Full Details Below

- How To Post A Bereal, Step-By-Step Guide